US Dollar Strength: Effects on Global Competitiveness

The current strength of the US dollar significantly impacts global competitiveness by affecting trade balances, investment flows, and the relative cost of goods and services across nations.

The current strength of the US dollar is a major talking point in global economics, but what does it truly mean for competitiveness on a global scale? Let’s delve into the multifaceted effects of a strong dollar, exploring who benefits, who faces challenges, and the overall implications for the international economy.

Understanding the US Dollar’s Strength

The strength of the US dollar is a key indicator of the global economy, reflecting its position as a reserve currency and a safe-haven asset. But what factors contribute to this strength, and how is it measured?

Drivers of Dollar Strength

Several factors can influence the value of the US dollar. These include:

- Interest Rate Differentials: Higher interest rates in the US attract foreign capital, increasing demand for the dollar.

- Economic Growth: Stronger US economic growth relative to other nations boosts confidence in the dollar.

- Geopolitical Stability: During times of global uncertainty, investors often flock to the dollar as a safe haven.

Measuring Dollar Strength

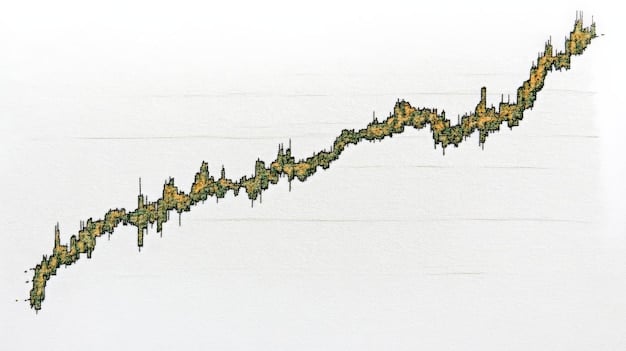

The strength of the US dollar is typically measured using indices like the US Dollar Index (DXY), which compares the dollar’s value against a basket of major currencies. A rising DXY indicates a stronger dollar.

In conclusion, the strength of the US dollar is influenced by a complex interplay of economic and geopolitical factors, and its measurement provides a valuable snapshot of the state of the global economy.

Impact on US Exports and Imports

A strong US dollar has a direct effect on the competitiveness of US exports and imports. Let’s examine these effects in detail.

Exports Become More Expensive

When the dollar is strong, US goods and services become relatively more expensive for foreign buyers. This can lead to:

- Decreased Export Volumes: Higher prices make US exports less attractive, potentially reducing export volumes.

- Lower Revenue for Exporters: Even if export volumes remain stable, exporters may need to lower prices to stay competitive, reducing revenue.

- Trade Deficit Widening: If exports decline while imports remain steady, the US trade deficit can widen.

Imports Become Cheaper

Conversely, a strong dollar makes imports cheaper for US consumers and businesses. This can result in:

- Increased Import Volumes: Lower prices make foreign goods more attractive, potentially increasing import volumes.

- Reduced Costs for Businesses: Businesses that rely on imported raw materials or components can see their costs decrease.

- Lower Consumer Prices: Cheaper imports can help keep inflation in check by lowering consumer prices.

In summary, a strong dollar tends to hurt US exporters while benefiting importers, with potential implications for the US trade balance and overall economic growth.

Effects on Emerging Markets

The strength of the US dollar has significant repercussions for emerging markets, many of which are heavily reliant on dollar-denominated debt.

Debt Burden Increases

Many emerging market countries borrow in US dollars. A stronger dollar means:

- Debt Servicing Costs Rise: As the dollar appreciates, emerging markets need more of their local currency to repay dollar-denominated debt.

- Financial Strain: This increased debt burden can strain government finances and potentially lead to debt crises.

- Reduced Investment Capacity: With more resources allocated to debt repayment, emerging markets may have less to invest in infrastructure and development.

Capital Flight

A strong dollar can also trigger capital flight from emerging markets as investors seek higher returns and safety in the US. This can lead to:

- Currency Depreciation: Capital outflows put downward pressure on emerging market currencies, further exacerbating debt burdens.

- Economic Instability: Currency depreciation can lead to inflation and economic instability.

- Reduced Foreign Investment: The perception of instability can deter foreign investment, hindering economic growth.

In conclusion, a strong US dollar can pose significant challenges for emerging markets, increasing their debt burdens and potentially triggering economic instability.

Impact on Commodity Prices

Commodity prices, often denominated in US dollars, are also affected by the dollar’s strength. Let’s explore this relationship.

Commodities Become More Expensive for Non-US Buyers

When the dollar strengthens, commodities like oil, gold, and agricultural products become more expensive for countries using other currencies. This can lead to:

- Decreased Demand: Higher prices can reduce demand for commodities in non-US markets.

- Lower Export Revenue for Commodity Exporters: Countries that export commodities may see their revenue decline.

- Inflationary Pressures: Countries that import commodities may face inflationary pressures as prices rise.

US Consumers Benefit from Lower Commodity Prices

For US consumers, a strong dollar can lead to lower prices for imported commodities, which can:

In summary, a strong dollar tends to lower commodity prices for US consumers while potentially hurting commodity exporters and increasing prices for non-US buyers.

Winners and Losers in a Strong Dollar Environment

The effects of a strong US dollar are not uniform; some sectors and countries benefit, while others face challenges.

Winners

The following typically benefit from a strong dollar:

- US Consumers: Cheaper imports and lower commodity prices increase purchasing power.

- US Importers: Lower costs for imported goods improve profitability.

- US Tourists: Traveling abroad becomes more affordable.

Losers

The following often face challenges in a strong dollar environment:

- US Exporters: Higher prices make their goods less competitive.

- Emerging Markets: Dollar-denominated debt burdens increase.

- Commodity Exporters: Demand and revenue may decline.

Understanding who benefits and who loses can help policymakers and businesses navigate the complexities of a strong dollar environment.

Strategies for Mitigating Negative Impacts

Businesses and policymakers can take steps to mitigate the negative impacts of a strong US dollar.

Hedging Currency Risk

Businesses can use financial instruments to hedge against currency fluctuations. These include:

- Forward Contracts: Locking in a future exchange rate.

- Options: The right, but not the obligation, to buy or sell currency at a specified rate.

- Currency Swaps: Exchanging principal and interest payments in different currencies.

Diversifying Markets

Companies can reduce their reliance on the US market by diversifying into other regions. This can help cushion the impact of a strong dollar on export sales.

Policy Interventions

Governments and central banks can intervene in currency markets to influence exchange rates. Tools include:

- Interest Rate Adjustments: Raising interest rates can attract foreign capital and strengthen the currency.

- Foreign Exchange Reserves: Buying or selling currency to influence its value.

- Quantitative Easing: Injecting liquidity into the economy to weaken the currency.

By implementing these strategies, businesses and policymakers can better manage the challenges posed by a strong US dollar and promote economic stability.

| Key Point | Brief Description |

|---|---|

| 💰 Export Impact | Reduces competitiveness; US goods become pricier. |

| 💸 Import Benefits | Imports become cheaper for US consumers & businesses. |

| 🌍 Emerging Markets | Increases debt burdens & can trigger capital flight. |

Frequently Asked Questions

▼

The US dollar strengthens due to factors such as higher interest rates, strong economic growth, and its status as a safe-haven asset during global uncertainty.

▼

A strong dollar makes US exports more expensive for foreign buyers, which can reduce export volumes and lower revenue for exporters.

▼

A strong dollar increases the debt burden for emerging markets and can trigger capital flight, potentially leading to economic instability.

▼

US consumers benefit from cheaper imports and lower commodity prices, while importers see improved profitability due to lower costs.

▼

Businesses can hedge currency risk using financial instruments and diversify into other markets to reduce reliance on the US market.

Conclusion

In conclusion, the current strength of the US dollar presents a complex scenario with winners and losers on the global stage. While US consumers and importers may benefit from cheaper goods, exporters and emerging markets face significant challenges. Understanding these dynamics is crucial for businesses and policymakers to navigate the complexities of the international economy effectively.